In extreme temperature variations of aerospace, stable signal transmission under ultra-high pressure in the deep sea, and reliable connections amid the complex electromagnetic environment of military equipment — special equipment connectors, as the “neural pathways” of high-end machinery, are embracing an unprecedented development window driven by global technological competition and the demand for equipment upgrading. From the global market to China’s sector, from technological breakthroughs to scenario expansion, the growth logic and competitive landscape of this niche not only concern the strategic layout of connector enterprises but also reflect the core path for China’s high-end manufacturing to “break through”.

I. Global and Chinese Markets: Dual-track Growth, China as a Core Growth Driver

In terms of market size, special equipment connectors exhibit the distinct traits of “steady global expansion and China leading in growth rate”. According to Grand View Research, the global special equipment connector market reached $26 billion in 2024, with a projected compound annual growth rate (CAGR) of 6.5% from 2024 to 2030, exceeding $38 billion by 2030. The Chinese market performs even more impressively: data from the Electronic Standards Institute of the Ministry of Industry and Information Technology shows that in 2024, the Chinese market size hit 58 billion yuan (approximately $8 billion), accounting for 30.8% of the global market, with a year-on-year growth of 11.5%. The Toubao Research Institute predicts that its CAGR from 2024 to 2030 will reach 13%, and the market scale is expected to surpass 125 billion yuan by 2030.

Behind this lies two core drivers for the Chinese market:

Policy-driven domestic substitution: Made in China 2025”lists “high-end electronic components” as a key breakthrough area. In 2024, the Ministry of Industry and Information Technology added a 1.5 billion yuan “special fund for high-end connector R&D”. Coupled with the rising localization rate of major equipment (e.g., the C919’s airborne connector localization rate rose from 45% in 2023 to 65% in 2024), domestic enterprises’orders have grown by over 40%.

Explosive demand in key sectors: Growth is fueled by projects like the Beidou-3 supplementary satellites (30 satellites planned for 2024–2026), increased procurement of army informatization equipment (up 18% year-on-year in 2024), and the “Major Deep-sea Exploration Project” (with over 5 billion yuan invested in 2024).

II. Segmented Scenario Analysis: Technical Demands and Market Potential in Three Key Fields

The core value of special equipment connectors lies in “adapting to extreme scenarios and ensuring high reliability”. Variances in technical requirements and market scales across different fields offer enterprises entry points for differentiated competition.

(I) Aerospace: Withstanding Extreme Environments, Commercial Aerospace as a New Growth Point

In 2024, the procurement scale of special connectors in China’s aerospace sector reached 18.5 billion yuan, with a projected CAGR of 12% from 2025 to 2030. Connectors in this field must overcome three challenges: “high temperature, radiation, and vibration”. For example:

Aircraft engine control system connectors need to endure temperatures of 180℃–250℃ and 20G vibration.

Low-orbit satellite connectors must resist 100 krad ionizing radiation (in line with GJB 548B-2005, China’s National Military Standard) and have an on-orbit lifespan exceeding 15 years.

Notably, the rise of commercial aerospace is reshaping the market. Take SpaceX’s Starlink program: a single satellite requires 50–80 aerospace-grade connectors (priced at $1,500–$2,000 each), and with over 5,000 satellites deployed globally, it directly drives procurement worth $3.75–$8 billion. China’s rapidly developing commercial aerospace also provides local connector enterprises with opportunities to “shift from supporting roles to leadership”.

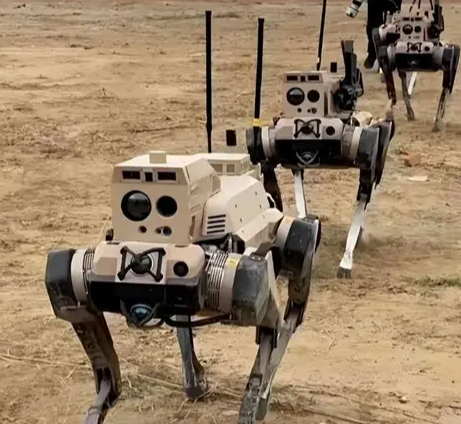

(II) Military Defense: Anti-interference, High Durability, and Rising Localization Rate

In 2024, the global military special connector market was approximately $9.2 billion, with China accounting for 28% (around $2.58 billion). Forecast International predicts the global market will reach $14.6 billion by 2030 (CAGR 8%). Military scenarios impose strict requirements on connectors’ “electromagnetic compatibility and environmental adaptability”:

Shielded connectors for the 99A tank must resist 1,000 V/m electromagnetic radiation (per GJB 151B-2013).

Waterproof connectors for naval vessels need a 99.5% salt spray test pass rate (per GB/T 2423.17-2008).

Miniature connectors for military drones must support 500 Mbps high-speed data transmission at a weight of just 2.5g.

As China’s military equipment localization rate requirement (currently ≥70%) continues to rise, local enterprises are accelerating the replacement of European and American brands. In 2024, enterprises like Aerospace Electric Appliances achieved a market share exceeding 30% in the military sector, with overseas revenue (from Southeast Asia and the Middle East) accounting for 22%.

(III) Deep-sea Exploration: High Pressure Resistance, Corrosion Prevention, and an Emerging Growth Pole

As the fastest-growing segment among the three, China’s deep-sea exploration special connector procurement scale reached 1.2 billion yuan in 2024, with a CAGR of 25% projected from 2025 to 2030. Connectors in this field must overcome the “10,000-meter-level high-pressure” bottleneck:

Connectors for the “Fendouzhe” deep-sea submersible can withstand 110 MPa pressure (equivalent to a 11,000-meter water depth) with a signal transmission attenuation rate <0.5%.

Connectors for China’s first seabed observation network “Neptune” have achieved 36 consecutive months of trouble-free operation.

With the global deep-sea exploration equipment market expanding (CAGR 18% from 2024 to 2030), this field is expected to become the “second growth curve” for China’s special equipment connector market by 2030, with a projected scale of 6.8 billion yuan.

III. Technological Upgrading and Competitive Landscape: How Chinese Enterprises Break Through

Currently, the global special equipment connector market is still dominated by European and American enterprises (with a 2024 revenue market share exceeding 60%). TE Connectivity’s high-speed backplane connectors (112 Gbps), Amphenol’s 500℃ high-temperature-resistant ceramic connectors, and Molex’s 3D-printed miniature connectors set benchmarks in different technical fields. However, Chinese enterprises are catching up rapidly through “technological breakthroughs + scenario deepening”. Enterprises such as AVIC Optoelectronics (45% market share in the aerospace sector), Aerospace Electric Appliances (over 30% market share in the military sector), and Zhongkexin Electronics (60% market share in deep-sea exploration) have established competitive advantages in segmented markets.

In the next 3–5 years, technological upgrading will focus on three directions — also the “keys to breakthrough” for Chinese enterprises:

High-speed transmission technology: Breaking through the 200 Gbps rate to meet next-generation radar and satellite communication needs (TE Connectivity has initiated R&D and is expected to mass-produce in 2026).

Extreme environment adaptation: Expanding the temperature tolerance range to -100℃–600℃ and breaking through deep-sea high-pressure sealing technology above 110 MPa.

Intelligent upgrading: Integrating temperature monitoring and fault diagnosis modules to reduce failure rates — the intelligent connector trialed by AVIC Optoelectronics in 2024 reduced the failure rate by 60% compared to traditional products in aerospace engine scenarios (from 1.2% to 0.48%).

IV. Our Layout: Adapting to Scenarios with Technology to Support China’s High-end Equipment Breakthrough

As an enterprise specializing in electronic connectors, automotive connectors, and wire harnesses, we have always regarded “extreme scenario adaptation” and “domestic substitution” as core strategies. Around the needs of the special equipment sector, we have built three core capabilities:

1. R&D of Extreme Environment Connectors: Addressing “Choke Point” Technologies Directly

Targeting the differentiated needs of aerospace, military defense, and deep-sea exploration, we have established a dedicated R&D team and collaborated with universities (e.g., the School of Materials, Harbin Institute of Technology) to tackle key technologies:

Aerospace: Developing aerospace-grade connectors resistant to 100 krad ionizing radiation, with a temperature tolerance range of -65℃–250℃, and certified by GJB 548B-2005.

Military: Shielded connectors offer 1,000 V/m electromagnetic interference protection, IP68 waterproof rating, and a 99.5% salt spray test pass rate, suitable for land, sea, and air equipment.

Deep-sea exploration: High-pressure-resistant connectors have passed a 60 MPa pressure test (equivalent to a 6,000-meter water depth) with a signal attenuation rate <0.5%, and are progressing toward 110 MPa (10,000-meter level) technology breakthroughs.

2. Customized Solutions: Rapid Response to Downstream Demands

A core pain point for special equipment connectors is “delayed demand feedback and long R&D cycles”. We have established a “equipment manufacturer – connector enterprise” joint R&D mechanism, dispatching engineers to downstream enterprises, shortening the R&D cycle of customized products from the industry average of 12 months to 6 months — enabling rapid adaptation to the personalized needs of satellites, drones, deep submersibles, and other equipment.

3. Global Standard Compliance: Facilitating Enterprises to “Go Global”

Our products strictly comply with dual international and domestic standards (e.g., ISO/IEC 11801, GJB series, GB/T series) and are compatible with European and American technical specifications. We have provided connector support for military equipment and deep-sea exploration projects in Southeast Asia and the Middle East, assisting China’s high-end equipment in “going global”.

V. Conclusion: Seize the Growth Wave and Co-build a Connected Future

The growth of the special equipment connector market is not merely a numerical increase but a microcosm of China’s high-end manufacturing transitioning from “following” to “leading”. In the future, we will continue to focus on emerging scenarios such as commercial aerospace, deep-sea exploration, and unmanned equipment, driving product upgrading through technological innovation, and providing reliable “connection support” for the localization and globalization of China’s special equipment. We also look forward to collaborating with more equipment manufacturers and research institutions to let the “Chinese Connection” be heard in global high-end manufacturing competition.

Products Recommendations:

| Product Category | Part Number | Altemative | Product Image |

| Automotive Connector | QA20012 | ||

| QA2006Y-20 | MOLEX 34824-0204 | ||

| QA2541 | |||

| Electronic Connector | T2508 | ||

| B1502 | |||

| Wiring Harness | 1002 | ||

| 2321 | |||

| 1635 |